New York County Property Appraiser

press-release-fy26-tentative-assessment-roll

Contact: Press Office AboutAnnual Roll Sets Tentative Values for All New York City Properties Tentative Tax Roll Shows Several Positive Economic Trends, Including a Rise in Office-to-Housing Conversions, an Increase in Total Market Value of All New York City Properties, and Strong Growth in the Residential Real Estate Market New York, NY— Department of Finance (DOF) Commissioner Preston Niblack today announced the publication of the tentative ...

https://www.nyc.gov/site/finance/about/press/press-release-fy26-tentative-assessment-roll.page

DiNapoli: Tax Cap Remains at 2% for 2026 | Office of the New York State Comptroller

The 2026 property tax levy growth will be capped at 2% for local governments that operate on a calendar-based fiscal year, according to data released today by State Comptroller Thomas P. DiNapoli. This figure affects tax cap calculations for all counties, towns, and fire districts, as well as 44 cities and 13 villages.

https://www.osc.ny.gov/press/releases/2025/07/dinapoli-tax-cap-remains-2-2026

Looking Back at 2025 to Prepare for the 2026 Tax Season ...

For example, the tentative roll released in 2026 will preview the assessments for the 2027-2028 tax year. This is essentially a more ...

https://natlawreview.com/press-releases/looking-back-2025-prepare-2026-tax-season-new-yorkS7663 | New York 2025-2026 | Authorizes the assessor of Nassau county to accept an application for retroactive real property tax exempt status from Al-Muneer Foundation, Inc. - Legislative Tracking | PolicyEngage

− Summary Authorizes the assessor of Nassau county to accept an application for retroactive real property tax exempt status from Al-Muneer Foundation, Inc. − Full Texts (2) − Actions (11) On January 7, 2026 in the Senate: - Referred To Local Government On January 7, 2026 in the Assembly: - Died In Assembly - Returned To Senate On June 12, 2025 in the Assembly: - Referred To Real Property Taxation...

https://trackbill.com/bill/new-york-senate-bill-7663-authorizes-the-assessor-of-nassau-county-to-accept-an-application-for-retroactive-real-property-tax-exempt-status-from-al-muneer-foundation-inc/2719734/

Assessment and Valuation Forms

Property owners have the right to challenge the Department of Finance’s assessments and correct inaccurate information related to their properties. The following forms are available for this purpose: After submitting your application, you will receive a notification with the Department of Finance's decision.

https://www.nyc.gov/site/finance/property/property-forms-assessments-and-valuations.page

2026 State Tax Changes Taking Effect January 1st | Tax Foundation

Forty-three states will ring in 2026 with notable taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. changes. Eight states will see reduced individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or...

https://taxfoundation.org/research/all/state/2026-state-tax-changes/

New Rochelle Overhauls Property Tax Assessment Calendar for 2026

At a recent legislative hearing, the New Rochelle City Council unanimously voted to revise the City’s property tax assessment calendar, with changes set to take effect for the upcoming 2026 assessment cycle, Regular Legislative Meeting-May 13, 2025 • Agendas & Minutes • CivicClerk.

https://www.farrellfritz.com/insights/tax-tracker/new-rochelle-property-tax-assessment-changes-2026/

York County Releases Proposed Budget for Fiscal Year 2026

York County Releases Proposed Budget for Fiscal Year 2026, Balancing Fiscal Responsibility and Taxpayer Relief March 19, 2025 The proposed FY 2026 budget totals $288 million across multiple funds, including the General Fund, Special Revenue Funds, Debt Service Funds, Capital Project Funds, Internal Service Funds, and Enterprise Funds.

https://www.yorkcounty.gov/CivicSend/ViewMessage/message/255668

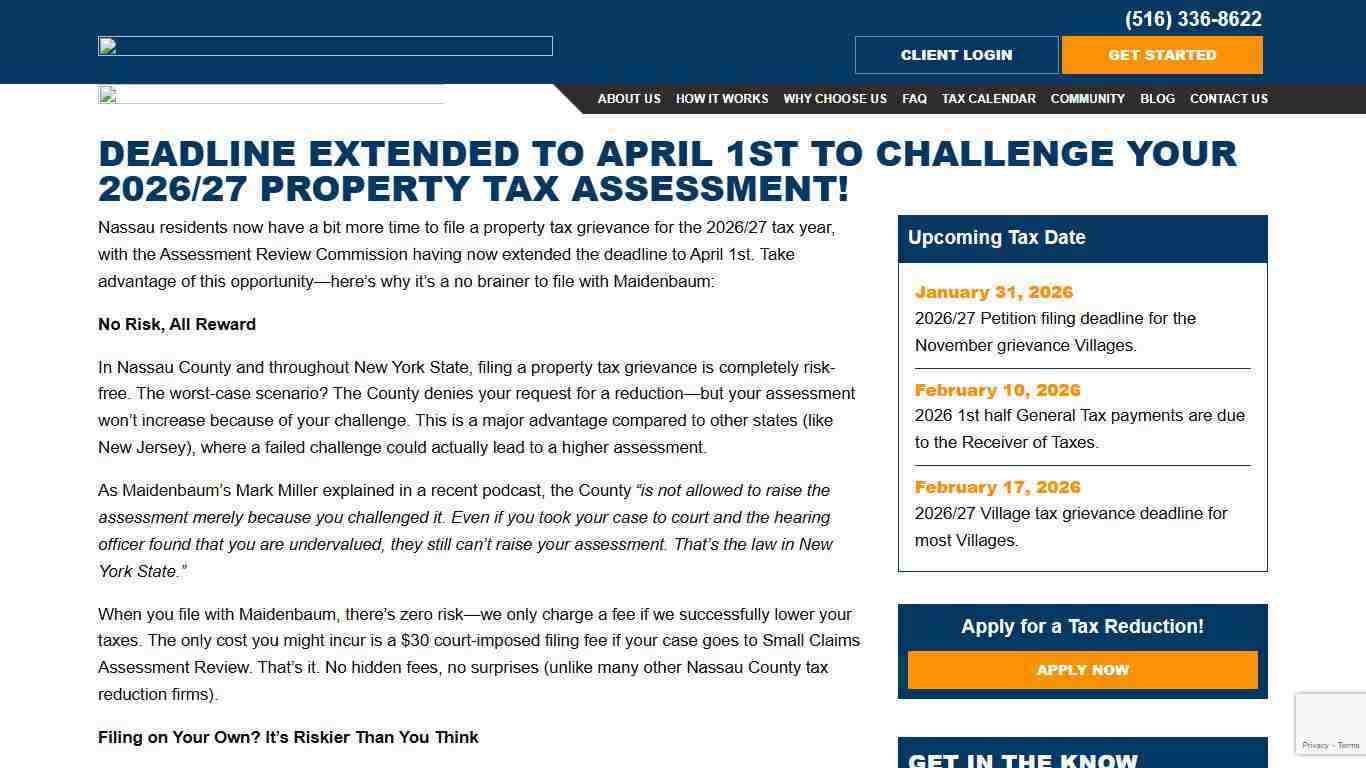

Deadline Extended to April 1st to Challenge Your 2026/27 Property Tax Assessment! - Maidenbaum Property Tax Reduction Group, LLC.

Nassau residents now have a bit more time to file a property tax grievance for the 2026/27 tax year, with the Assessment Review Commission having now extended the deadline to April 1st. Take advantage of this opportunity—here’s why it’s a no brainer to file with Maidenbaum: No Risk, All Reward In Nassau County and throughout New York State, filing a property tax grievance is completely risk-free.

https://www.maidenbaumtax.com/blog/deadline-extended-to-april-1st-to-challenge-your-2026-27-property-tax-assessment/

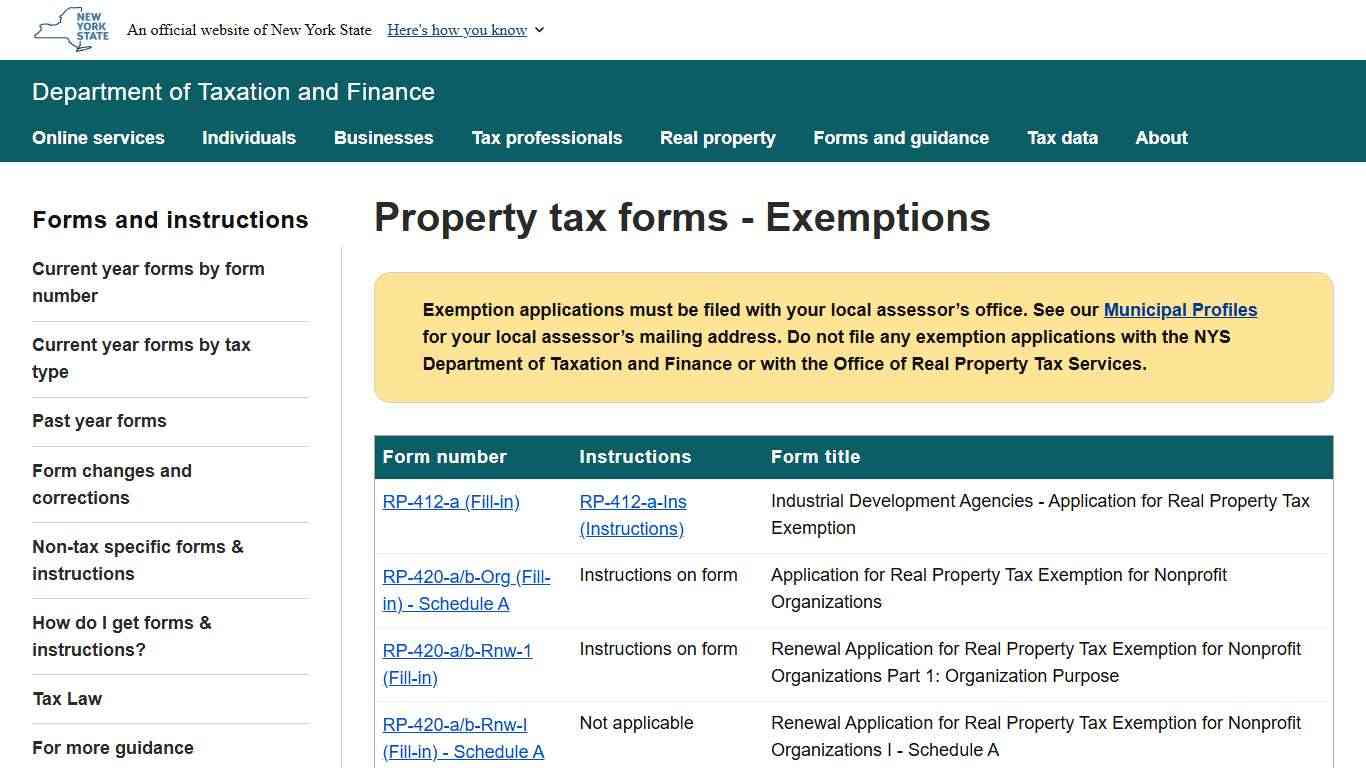

Property tax forms - Exemptions

Application for Conservation Easement Agreement Exemption: Certain Towns (Guilderland and Danby)...

https://www.tax.ny.gov/forms/orpts/exemption.htm

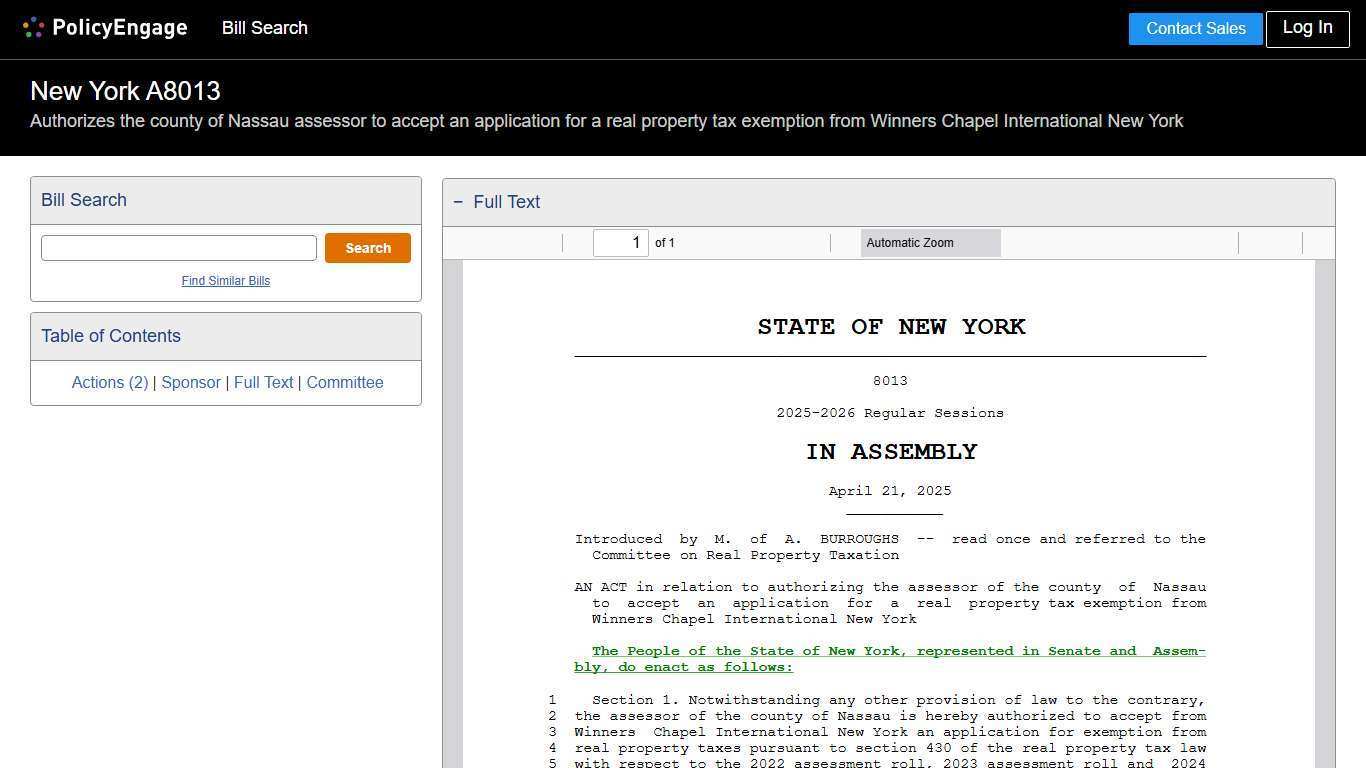

A8013 | New York 2025-2026 | Authorizes the county of Nassau assessor to accept an application for a real property tax exemption from Winners Chapel International New York - Legislative Tracking | PolicyEngage

− Full Text − Actions (2) On January 7, 2026 in the Assembly: - Referred To Real Property Taxation On April 21, 2025 in the Assembly: - Referred To Real Property Taxation...

https://trackbill.com/bill/new-york-assembly-bill-8013-authorizes-the-county-of-nassau-assessor-to-accept-an-application-for-a-real-property-tax-exemption-from-winners-chapel-international-new-york/2718244/

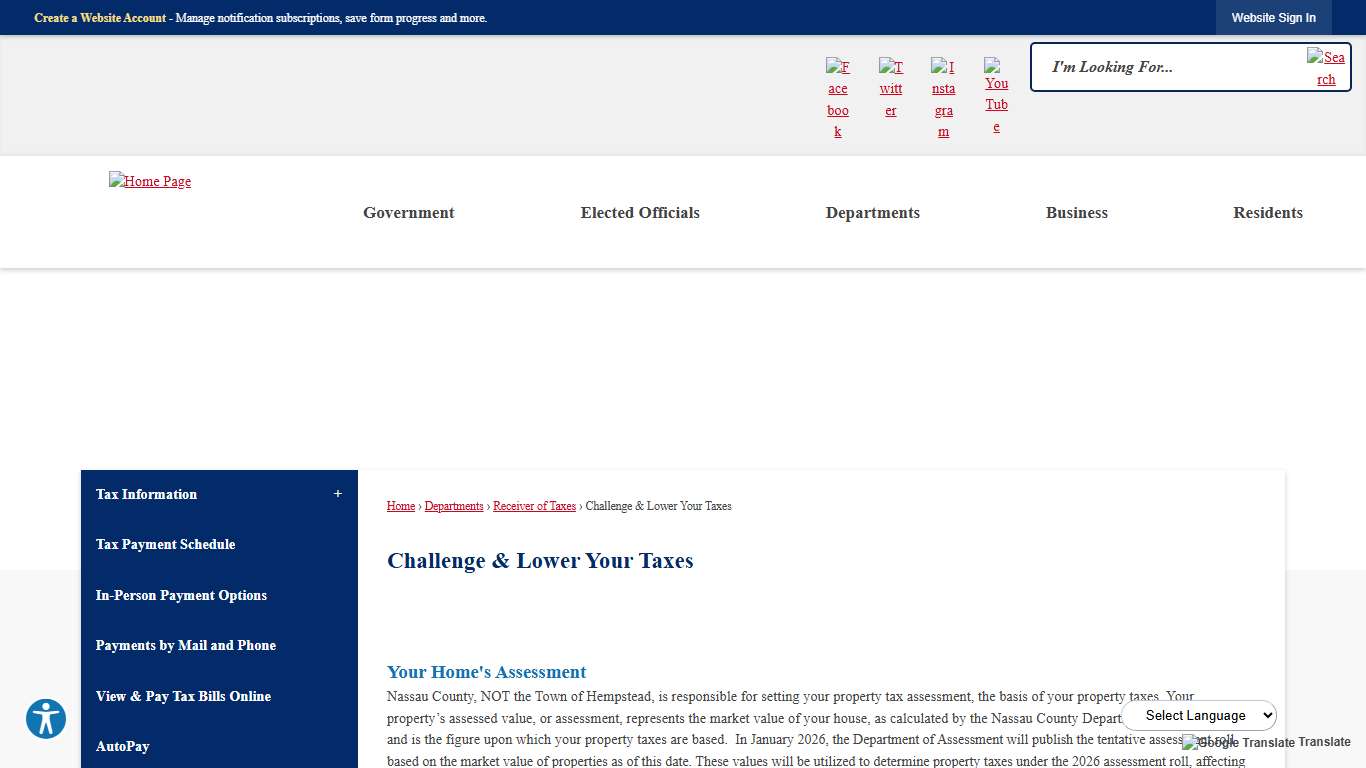

Challenge & Lower Your Taxes | Hempstead Town, NY

Challenge & Lower Your Taxes Your Home's Assessment Nassau County, NOT the Town of Hempstead, is responsible for setting your property tax assessment, the basis of your property taxes. Your property’s assessed value, or assessment, represents the market value of your house, as calculated by the Nassau County Department of Assessment, and is the figure upon which your property taxes are based.

https://hempsteadny.gov/369/Challenge-Lower-Your-Taxes

Jenkins Releases 2026 Budget Proposal in Face of Historic Fiscal Pressure From Federal Government

Jenkins Releases 2026 Budget Proposal in Face of Historic Fiscal Pressure From Federal Government $2.5B Plan Cuts Nearly Every Department by 8% While Preserving Essential Services and Avoiding Layoffs Westchester County Executive Ken Jenkins has announced his first proposed Operating Budget for 2026.

https://www.westchestergov.com/all-press-releases/jenkins-releases-2026-budget-proposal-in-face-of-historic-fiscal-pressure-from-federal-government

New York State Budget: Understanding Tax Changes - Anchin, Block & Anchin LLP

After months of deliberation, New York State has finally passed its 2026 fiscal year budget. Originally due April 1, 2025, it goes down as the largest budget in the state’s history, totaling $254 billion. While it prioritizes investments across various sectors, including climate initiatives, childcare funding, infrastructure improvements, and public safety, there are various tax-related provisions.

https://www.anchin.com/articles/new-york-states-2026-fiscal-year-budget-finally-passes/

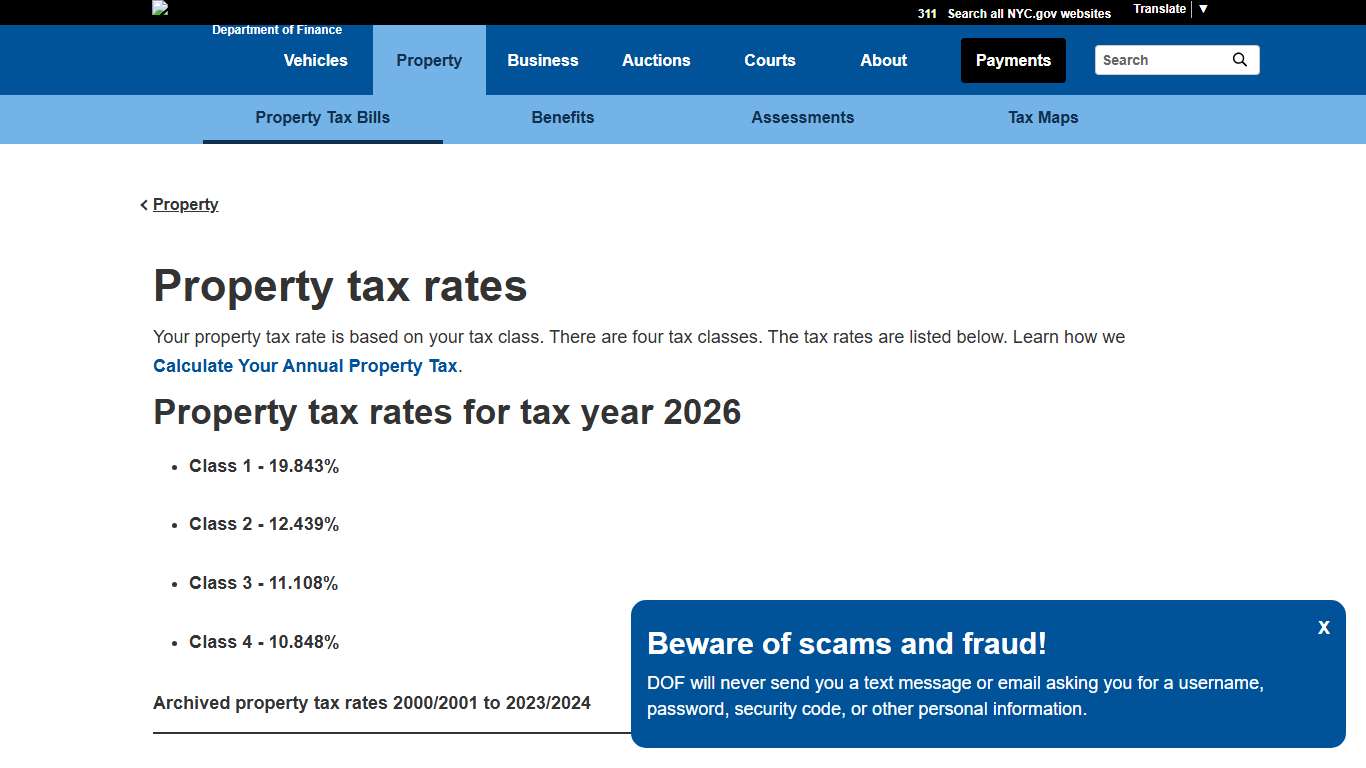

Property Tax Rates

PropertyProperty tax rates Your property tax rate is based on your tax class. There are four tax classes. The tax rates are listed below. Learn how we Calculate Your Annual Property Tax. Property tax rates for tax year 2026 - Class 1 - 19.843% - Class 2 - 12.439% - Class 3 - 11.108% - Class 4 - 10.848% School tax rates for tax years 1981-2018 Historically, school tax rates...

https://www.nyc.gov/site/finance/property/property-tax-rates.page

2025/2026 Final Assessment Roll | Southampton, NY - Official Website

Use the documents to find your property's assessment on the rolls.

https://www.southamptontownny.gov/136/Assessment-Rolls---Final-20252026

New York State Property Tax Report Card : Educational Management : P-12 : NYSED

New York State Property Tax Report Card ****Please use Chrome or Firefox when entering the Business portal to complete the PTRC. Internet Explorer is NOT recommended.***** New for 2020-21: Pursuant to a December 27, 2019 update to 20 NYCRR (Regulations of the Commissioner of Tax and Finance), Capital Expenditures for BOCES paid for through its component school districts will now be included in the calculation of each school district’s Capital...

https://www.p12.nysed.gov/mgtserv/propertytax/

The 2026 property tax bills are... - Town of Van Buren | Facebook

The 2026 property tax bills are finally available online at www.ongov.net...departments...real property...1st box on the left for tax bills or you can call the office 315-635-3010 or email [email protected]. Between the snow and New Year's Day holiday my best guess is the county will mail them the week of Jan 5th.

https://m.facebook.com/100064281446096/posts/the-2026-property-tax-bills-are-finally-available-online-at-wwwongovnetdepartmen/1251144510371585/

Warren County supervisors adopt 2026 budget | Warren County

The Warren County Board of Supervisors has approved a 2026 county budget that adjusts to increases in mandated costs but continues to maintain one of the lowest property tax rates in New York State while investing in public safety and infrastructure.

https://www.warrencountyny.gov/news/warren-county-supervisors-adopt-2026-budget